|

PDF file

published

in Haaretz on June 12, 2006.

Education or Interest

by Dan Ben-David It’s budget-building season, and this

year brings with it good tidings: the country is coming out of the recession

and there is money available. This is

the sort of reality that beckons many MKs and cabinet ministers – and leading

them is Defense Minister Amir Peretz who announced, “the citizens of Israel

need both welfare and security and in these days of budget surplus, there is no

reason to continue cutting the defense budget” (Ynet, May 29). Is that so? One of the so-called stylized facts

that characterizes growth paths is their steadiness over decades. Along a growth path, there are periods of

recession and subsequent boom periods that repeat themselves over time, or

“business cycles” as they are commonly referred to. When a country enters a recession, the

decline in economic activity leads to lower tax revenues for the government. The recession is then followed by boom years

in which the economy returns to its long-run growth path. The greater the increase in economic activity,

the greater the tax revenues. If the government were to adjust its

expenditures to its income in each year, it would have to cut its spending

during recessionary periods in which aid is much more in demand, and behave in

just the opposite manner during periods of economic boom. Therefore, the government’s goal should not

be to balance its budget on an annual basis but to adhere to a stable spending

path with deficits in lean years and surpluses in good years. This has non-negligible implications regarding

budget responsibility over time. But the mentality here is that in

tough times the government must step in and provide assistance while in easier

times there are surpluses that it is a shame not to utilize, as Defense

Minister Peretz so succinctly stated. This

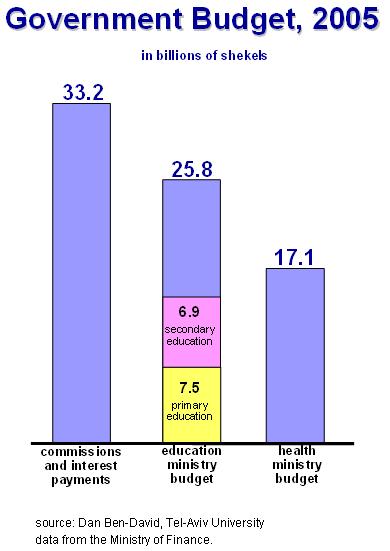

type of world-view has led to the situation depicted in the graph – a picture

that needs to be branded in the minds of every politician and every citizen who

has the right to vote. A government is no different than a

household. There are incomes (primarily

from taxes) and there are expenditures. If

expenditures exceed incomes, then it is necessary to borrow money. When one takes out loans, then the day of

reckoning eventually comes and the loans need to be repaid – with interest. A very substantial portion of each

year’s national budget goes toward repayment of the principal. However, beyond having to return the money

that we borrowed, we are also obligated to pay a “penalty” on our inability –

or our lack of willingness – to live within our means. This “penalty” is reflected in the portion of

the budget that is channeled toward interest payments at the nearly

unimaginable level of 33 billion NIS last year alone. For those who do not fully comprehend

the dimensions of this expenditure, we are basically throwing away an amount

that is 29% greater than the entire education budget, and 2.3 times as much as

the combined budget for primary and secondary education. As irony would have it, in a country who

interest payments are twice the entire health budget, there are insufficient

funds in that same budget to fund a normal medicine basket that would allow a

decent quality of life for our ill and ailing. The time has come to make the

transition from budget wantonness to national responsibility and accountability. There are no separate, more convenient, economic

laws for those who do not understand basic concepts such as “budget constraint”. Whoever wants more education, health and

welfare needs to understand that if we pay less interest each year, there will

be more funds available for the true needs of Israeli society. This requires that in good years we utilize

the surpluses to reduce the national debt – and that necessitates that our

elected representatives determine a new set of national priorities that

represents a wiser distribution of our limited budget. comments

to:

danib@post.tau.ac.il

|